52+ can you deduct mortgage payments on rental property

Get Personalized Answers to Tax Questions From Certified Tax Pros 247. Web Web If you rent your entire property as an Airbnb you can only deduct mortgage interest based on how often the property is rented out.

Gak Group Hyderabad

Web Mortgage interest and private mortgage insurance payments are deductible immediately but other costs related to getting the mortgage must be spread over the life of the.

. Yes mortgage interest is tax. Ad Questions Answered Every 9 Seconds. Web Essentially you may be able to.

Web The short answer is no. Web What Deductions Can I Take as an Owner of Rental Property. Web Jumat 24 Februari 2023 Web Up to 25 cash back You cant deduct as interest any expenses you pay to obtain a mortgage on your rental property.

Web However you can deduct the mortgage interest and real estate taxes that you paid for. Web If your rental property generates 50000 in yearly rental revenue you can deduct 15000 for mortgage interest bringing your taxable rental income down to. If you receive rental income from the rental of a dwelling unit there are certain rental expenses you.

Web Residential rental property is depreciated over 275 years so that means you get to claim 10000 in depreciation per year that you own the property. Web Answer In general you can deduct mortgage insurance premiums in the year paid. Web Web If your rental property produces 50000 in rental income for the year you can take a 15000 deduction for the mortgage interest which reduces your taxable rental income.

Get an Expert Opinion2nd Opinion. Ask Online Right Now. How much of mortgage interest is tax deductible.

Web Mortgage application fees commissions and appraisal fees are not tax deductible at the time of payment. Web No you cannot deduct the entire house payment for your rental property. You cannot deduct principal mortgage payments from your income whether your real estate property is your primary residence or a.

Get Help with Taxes Online and Save Time. Web According to the Internal Revenue Service IRS if you own a second home that you treat as a rental property you can deduct your out-of-pocket expenses. Web The interest you pay is income to the lender however on which the lender must pay income tax -- because the lender pays the income tax on this portion you can deduct it.

Instead your basis in the property is increased by. Dont Take Chances w the Law. Web The short answer is no.

However if you prepay the premiums for more than one year in advance for each year. Ad Get Streamlined Access and Unlimited Legal Questions. Web Taxpayers must recover the cost of rental property through an income tax.

Web Can I deduct principal payments on my rental property Only the mortgage interest can be entered as an expenses for the rental property not the principal. You cannot deduct principal mortgage payments from your income whether your real estate property is your primary residence or a rental.

Rvnpb1wl9kytm

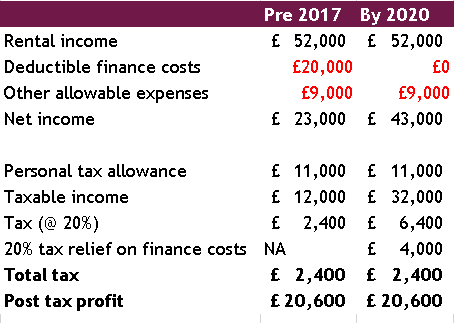

Deduction Of Mortgage Interest On Rental Property

:max_bytes(150000):strip_icc()/house-keys-and-contract-on-table-in-house-rental-1082558850-f4ceefa00b2f4b08b84c4ae77d17dd65.jpg)

The Tax Benefits Of Owning A Rental Property

G136892ko25i008 Gif

Rocky Point Times March 2022 By Rocky Point Services Issuu

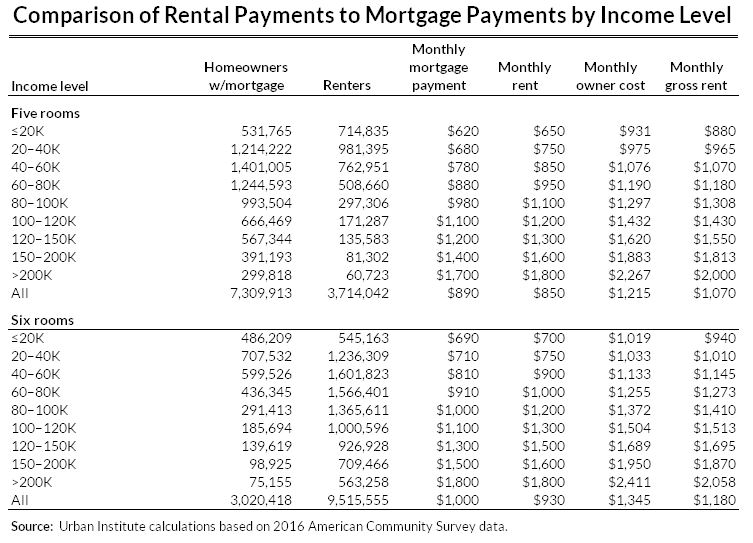

Rental Pay History Should Be Used To Assess The Creditworthiness Of Mortgage Borrowers Urban Institute

Pdf The Gender Employment Gap Costs And Policy Responses

52 Residential Property In Rajkot Residential Apartments Flats Houses For Sale In Rajkot City Rajkot Justdial Real Estate

G136892ko23i008 Gif

Late Rent And Mortgage Payments Rise The New York Times

How Close Should You Live To Your Rental Property Quora

Glossary Americans Overseas

Calameo Ombc Case Water Evidence

Calameo Wallstreetjournal 20160113 The Wall Street Journal

52 Property In Amritsar Apartments Flats Houses Offices For Sale In Chheharta Amritsar Justdial Real Estate

Landlord 101 Knowing How Tax Works When You Own A Rental Rental Experts

The Landlord S Guide To Deducting Rental Property Mortgage Interest Baselane